The article explains the V5 INC RET PS code used by banks to indicate a cheque or transaction issue, detailing the causes of bounced cheques, handling steps, and prevention tips.

What is V5 INC RET PS:

V5 INC RET PS is a code used by banks to indicate a specific issue related to a transaction or a cheque. When a cheque is returned or rejected due to certain discrepancies or errors, this code is often associated with the transaction. It serves as an alert for both the bank and the account holder that there is an issue requiring attention.

Breaking Down the Code:

Understanding the components of the V5 INC RET PS code can help clarify the specific problem:

- V5: This segment typically refers to the transaction or banking operation code, unique to the institution’s internal processes.

- INC: Stands for “inconsistency,” indicating that there is an issue or discrepancy with the transaction.

- RET: Short for “return,” signifying that the cheque or transaction has been returned to the issuer.

- PS: Could denote a specific problem or system involved, though it may vary between institutions.

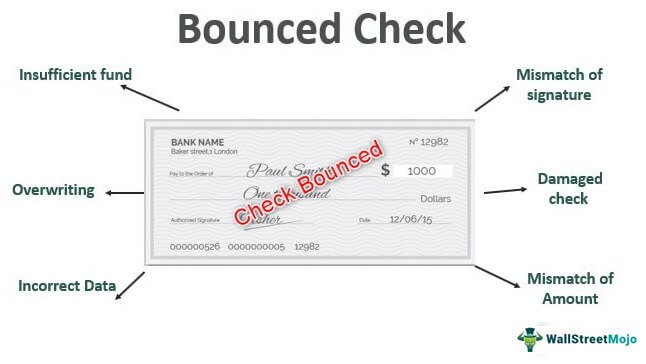

Why Do Cheques Bounce:

Several factors can lead to a cheque bouncing, each reflecting a different underlying issue:

Insufficient Funds:

The most common reason a cheque bounces is due to insufficient funds in the issuer’s account. If the account balance is lower than the cheque amount, the bank cannot process the payment.

Incorrect Information:

Errors in the cheque details can also cause a bounce. This might include incorrect account numbers, wrong payee names, mismatched signatures, or any other discrepancies in the filled details.

Stale Dated Cheques:

Cheques have a validity period, usually six months from the date of issue. Presenting a cheque after this period can result in it being considered stale and subsequently bounced.

Account Closure:

If the account from which the cheque is drawn has been closed, any cheque issued from that account will be automatically rejected and returned.

Stop Payment:

Sometimes, the issuer of a cheque may request the bank to stop payment on it. This could be due to various reasons such as the cheque being lost or a dispute with the payee.

Fraudulent Activity:

Banks are on the lookout for any suspicious activity. If a cheque is suspected to be fraudulent, the bank may bounce it to prevent any potential fraud.

Also read: Ilan Tobianah – A Multi-Faceted Journey Through Life and Career!

How to Handle a V5 INC RET PS Code:

Encountering a V5 INC RET PS code requires a systematic approach to resolve the issue effectively:

Contact TD Bank Customer Support for Clarification:

The first step is to get in touch with TD Bank’s customer support. They can provide detailed information on why the cheque was returned and guide you on the necessary steps to rectify the situation. Their support team is trained to handle such queries and can offer insight into the specific nature of the issue.

Discuss with the Sender for a Resolution:

It’s crucial to communicate with the person or entity that issued the cheque. Explain the situation and ask them to verify the details of the cheque. They might need to issue a new cheque or provide the necessary corrections to resolve the discrepancy.

Who to Contact About the V5 Inc Ret Ps Error Code:

To resolve a V5 INC RET PS error code, consider reaching out to the following:

Your Bank:

Your bank is the primary point of contact for any issues related to cheque returns. They can offer detailed explanations and guide you on the next steps to take.

The Cheque Issuer:

Communicate with the cheque issuer to understand any potential mistakes or issues from their end. They might need to rectify errors or issue a new cheque.

Customer Support Services:

In some cases, contacting customer support services for both the bank and the cheque issuer can provide additional assistance and clarification.

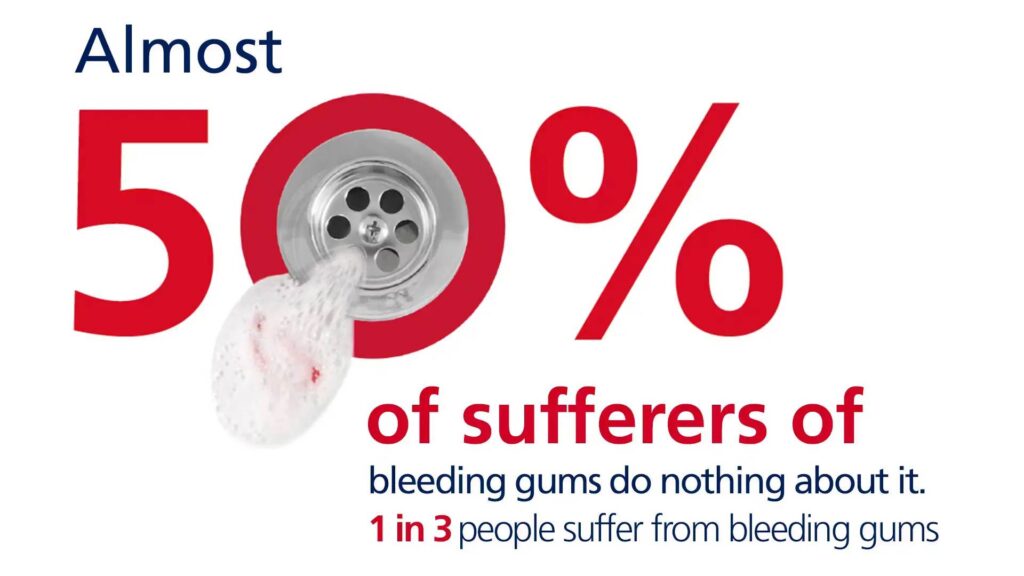

How to Protect Against Gum Disease Problems:

Maintaining good oral hygiene is essential to protect against gum disease. Here are some tips:

Brush Twice Daily:

Brush your teeth with fluoride toothpaste at least twice a day. To get rid of plaque and bacteria, make sure you brush your tongue as well as all of your teeth’s surfaces.

Floss Daily:

Flossing helps remove food particles and plaque from between your teeth and along the gum line, areas where a toothbrush might not reach effectively.

Regular Dental Check-ups:

Visit your dentist at least twice a year for routine check-ups and cleanings. Regular dental visits can help identify and address issues early before they become more severe.

Healthy Diet:

A balanced diet rich in vitamins and minerals, particularly calcium and vitamin C, supports gum health. Avoid excessive consumption of sugary foods and drinks, which can contribute to plaque build-up.

Quit Smoking:

Smoking significantly increases the risk of gum disease. If you smoke, seek help to quit as it will greatly improve your oral and overall health.

Also read: Sonya Hamlin Idris Elba – A Comprehensive Biography!

What Does “OTP” in a Text Mean:

Definition:

OTP stands for One-Time Password. It’s a security feature used to verify a user’s identity and ensure that transactions or logins are authorized.

Text Examples:

- “Your OTP for logging in is 123456.”

- “Please enter the OTP sent to your mobile to confirm the transaction.”

- “For security purposes, your OTP is valid for the next 10 minutes.”

Philippine Folklore: Nuno Sa Punso

Overview:

Nuno sa Punso is a mythical creature in Philippine folklore, often depicted as an old man living in anthills or termite mounds. These beings are believed to have magical powers and can bring either good or bad luck, depending on how they are treated.

Cultural Significance:

The Nuno sa Punso is deeply rooted in Philippine culture. Disturbing their home is thought to bring bad luck or illness to the person responsible. Respect for these creatures is taught from a young age, and many Filipinos still practice rituals to avoid offending them, such as saying “tabi-tabi po” (excuse me) when passing by mounds.

Whose Fault is It That My Cheque Bounced?

Determining fault when a cheque bounces can help address the issue more effectively:

Issuer’s Fault:

- Insufficient Funds: The issuer didn’t have enough money in their account.

- Incorrect Details: Errors in the filled-out cheque.

- Account Closure: The account has been closed but cheques were still issued.

Bank Error

- Processing Mistakes: Sometimes banks make errors in processing cheques.

- Technical Glitches: Issues within the bank’s system can cause cheques to bounce incorrectly.

Recipient’s Fault:

- Delayed Presentation: Presenting the cheque after a long period.

- Deposit Errors: Mistakes made while depositing the cheque.

Tips on How to Avoid Encountering the V5 INC RET PS Code:

Here are some tips to avoid the V5 INC RET PS code:

Ensure Sufficient Funds:

Always make sure there is enough money in your account before issuing a cheque. Keeping track of your account balance can help prevent issues.

Double-Check Details:

Verify all the details on the cheque, including the amount, date, and payee information, before issuing it. Ensure your signature matches the one on file with your bank.

Present Cheques Promptly:

Deposit cheques as soon as possible to avoid issues with stale dates.

Communicate with the Issuer:

If you suspect any potential issues, contact the issuer immediately to verify the cheque details.

Consequences of a Bounced Cheque:

Bouncing a cheque can have several negative consequences:

Bank Fees:

Both the issuer and the recipient may incur fees from their respective banks due to the bounced cheque.

Negative Credit Impact:

Repeated incidents of bounced cheques can negatively affect your credit score, making it harder to obtain loans or credit in the future.

Legal Consequences:

In some cases, particularly with larger amounts or repeated offences, you might face legal action.

Trust Issues:

A bounced cheque can damage trust and relationships with the recipient, whether it’s a business or personal relationship.By understanding and addressing the reasons behind the V5 INC RET PS code, you can prevent cheque-related issues and maintain smooth financial transactions.

Ensuring proper communication, sufficient funds, and correct details can help avoid the inconvenience and consequences of bounced cheques.

FAQ’s:

1. What does the V5 INC RET PS code mean?

V5 INC RET PS is a code indicating a returned or rejected cheque due to discrepancies or errors in the transaction.

2. Why do cheques bounce?

Cheques bounce primarily due to insufficient funds, incorrect information, stale dates, account closure, stop payments, or suspected fraud.

3. How can I resolve a V5 INC RET PS code issue?

Contact your bank’s customer support for clarification and discuss the issue with the cheque issuer to rectify any errors or get a new cheque.

4. What steps can I take to avoid bounced cheques?

Ensure sufficient funds, double-check cheque details, present cheques promptly, and maintain good communication with the cheque issuer.

5. What are the consequences of a bounced cheque?

Consequences include bank fees, negative credit impact, potential legal action, and damaged trust with the recipient.

Conclusion:

Understanding the V5 INC RET PS code is crucial for effectively managing cheque and transaction issues. By recognizing the common causes of bounced cheques, such as insufficient funds or incorrect details, you can take proactive steps to prevent these errors. Effective communication with your bank and the cheque issuer is essential for resolving discrepancies promptly.